In our previous blog, we examined the complexities of healthcare insurance claims processing that have real consequences for patient care— delayed treatments, financial hardships, and eroded trust in the healthcare system. We explored how generative AI improves patient outcomes through claims automation, ultimately ensuring that patients receive the timely, affordable care they need.

Now, we take a deeper dive into Neudesic’s Document Intelligence Platform—an AI-powered solution designed for claims automation that keeps patients and providers at the heart of the transformation. While automation often focuses on cost reduction, our focus here is on the human impact: improving experiences, reducing administrative burdens, and ensuring faster reimbursements for all stakeholders involved.

7 steps to successful claims automation

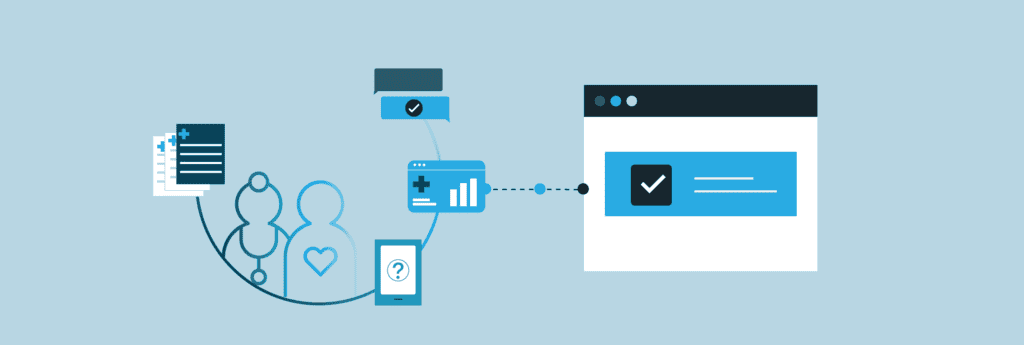

The journey of a health insurance claim is complex, involving multiple steps from initial intake to adjudication, stressing the importance of claims automation. Neudesic’s Document Intelligence Platform optimizes each stage of claims processing using AI-driven modules that reduce errors, speed up processing, and improve accuracy. By minimizing manual intervention, payers can significantly decrease processing time, reduce administrative bottlenecks that often delay care, and provide faster reimbursements for patients.

There are 7 steps to successful claims automation to foster better health outcomes across the board.

1. Pre-processing

The first step in automating claims processing is pre-processing, where the platform ingests and prepares incoming documents for classification and extraction. By ensuring all documents are in a machine-readable format, this step minimizes errors and sets the foundation for accurate data extraction. As a result, pre-processing reduces data inconsistencies early in the process, preventing downstream errors and rework.

2. Document type classification

Using AI-powered classification, the various claim forms are identified and routed to the appropriate workflows, ensuring that each claim is processed according to its specific requirements. This step enhances efficiency by directing claims to the right processing stream without manual sorting, reducing processing delays and human error.

3. Benefit type classification

Once classified, the claims undergo benefit type classification, where the platform determines the relevant coverage category—medical, dental, vision, or another benefit type. By directing each claim to the appropriate processing workflow, this step ensures accurate application of benefit-specific rules and calculations. Consequently, this reduces claim misrouting, improving the accuracy of benefit application and ensuring faster approvals.

4. Extraction

The fourth step is extraction, where the platform leverages AI-driven techniques to capture critical claim details such as member information, procedure codes, and billed amounts. Whether dealing with structured forms, unstructured documents, or complex medical charts, the platform dynamically extracts relevant data. This ensures high accuracy even when working with varied document layouts.

5. Business rules application

The system standardizes provider and member data, aligns procedure codes, and segments multi-transaction claims. By enforcing consistency across different claim components, this step ensures that the extracted information is ready for validation and adjudication. It also ensures uniformity across claims, improving data integrity and reducing claim disputes.

6. Validation

Validation is a crucial step to maintain accuracy and compliance. The platform performs thorough checks to ensure completeness, logical consistency, and alignment with reference data. By automating these validation checks, payers can experience reduced claim denials due to missing or incorrect information, ensuring that only clean, accurate claims move forward in the process.

7. Adjudication

In this step, claims are either approved for Straight-Through Processing (STP) or flagged for manual review if exceptions arise. STP enables faster reimbursements by allowing fully validated claims to move directly to payment processing without manual intervention. For more complex cases, flagged claims are directed to human adjudicators for further assessment. This significantly accelerates payment cycles, ensuring that patients and providers receive timely reimbursements.

4 benefits to claims automation

Claims automation delivers significant advantages for all stakeholders in the healthcare ecosystem—providers, payers, and patients alike. In fact, patients have reported 20% greater satisfaction due to reduced delays in receiving reimbursements. Faster claim approvals, fewer errors, and enhanced transparency not only ensure smoother transactions but also build trust among patients and healthcare providers. Below, we explore four key benefits of claims automation and how Neudesic’s Document Intelligence Platform is transforming the industry.

1. Reduced administrative burdens for healthcare providers

One of the most significant challenges providers face is the administrative workload associated with claims submission and follow-up. Traditional claims processing often involves repeated resubmissions due to missing or incorrect information, consuming valuable time that could be spent on patient care. Neudesic’s Document Intelligent Platform minimizes these inefficiencies by automatically detecting and flagging incomplete fields, inconsistencies, or missing documentation before submission. This reduces claim denials, shortens payment cycles, and allows providers to focus on what truly matters—delivering quality care to their patients.

2. Faster reimbursements for patients

Delayed claims processing can have serious consequences for patients who rely on timely reimbursements to cover medical expenses. Slow processing times often lead to financial stress and delayed treatments. By leveraging advanced AI-driven validation and adjudication, Neudesic’s platform accelerates Straight-Through Processing (STP), enabling claims to be approved and reimbursed within hours rather than weeks. This rapid turnaround time provides patients with much-needed financial relief and ensures that they can continue their treatments without unnecessary disruptions.

3. Fraud detection and improved accuracy

Errors in claims processing not only lead to delays but also contribute to frustration among patients, providers, and insurers. Incorrectly processed claims require additional manual review, increasing the workload for all parties involved. The AI-powered extraction and validation capabilities within Neudesic’s platform significantly improve accuracy by automatically identifying discrepancies, validating provider credentials, cross-referencing procedural codes, and detecting fraudulent patterns in real time. By flagging duplicate submissions or altered documents early in the process, the platform minimizes financial losses associated with fraud. This proactive approach minimizes rework, reduces errors, and ensures a smoother claims experience for everyone.

4. Building trust and transparency in the healthcare ecosystem

One of the biggest frustrations for both patients and providers is the lack of transparency in claims processing. Confusion over denied claims, unclear explanations of benefits, and long wait times can erode trust in the healthcare system. By automating key steps and providing real-time insights into claim status, Neudesic’s platform fosters greater transparency. Patients and providers can track the progress of claims in real-time, understand reasons for denials, and receive clear guidance on next steps—all of which contribute to a more positive and trust-driven experience.

A Future-Ready Solution for a Patient-Centric Industry

By prioritizing people over profit, Neudesic’s Document Intelligence Platform is setting a new standard in healthcare claims processing—one that aligns with the industry’s ultimate mission: delivering timely, accessible, and high-quality care to those who need it most.

Stay tuned for the next installment in our series, where we’ll explore the broader financial impact and scalability of AI-driven claims automation. In the meantime, if you’re ready to enhance your claims process and create a seamless experience for your patients and providers, contact Neudesic today to learn more.

Related Posts