With every holiday season, retailers face the most critical period of the year. With Christmas shopping in full swing, the demand for efficiency, security, and sustainability reaches its peak. To meet these heightened expectations, retailers are turning to data and AI-driven solutions to optimize operations, protect customer data, and demonstrate their commitment to sustainability. By embracing advanced technologies, retailers can create seamless holiday shopping experiences, build consumer trust, and ensure long-term growth well beyond the festive season.

Driving Sustainability in Retail: Meeting Consumer and Regulatory Demands

Sustainability is becoming increasingly more critical for retailers as consumers and regulators demand greater transparency and accountability. To stay competitive, retailers must prioritize sustainability and align with emerging regulations that emphasize measurable actions over vague claims.

The Rise of Sustainability Regulations

Global sustainability regulations are driving retailers to adopt clear, verifiable practices. In fact, the 2022 Inflation Reduction Act allocated $370 billion toward clean energy and climate initiatives. Retailers that fail to comply risk fines, reputational damage, and loss of consumer trust.

Why Sustainability Matters

Today’s consumers are more discerning than ever. Young shoppers are increasingly willing to pay premiums for eco-friendly products. Retailers that demonstrate authentic sustainability efforts can build stronger brand trust, attract more loyal customers, and ultimately increase revenue.

Strong ESG (Environmental, Social, and Governance) performance is becoming increasingly critical for investors and board members. This is because companies with robust ESG practices are seen as future-ready and lower-risk.

The Role of AI in Advancing ESG Initiatives

To meet growing ESG expectations, retailers must move beyond manual tracking methods and adopt data-driven strategies. Advanced analytics plays a pivotal role in this transformation, providing retailers with the tools to track, measure, and improve their sustainability performance.

How AI Supports ESG:

- Environmental Insights: Track energy consumption, waste, and carbon emissions to identify inefficiencies and reduce environmental impact.

- Social Responsibility Tracking: Measure diversity, equitable hiring, and labor practices.

- Governance Monitoring: Meet regulatory compliance and ensure supply chain partners meet the same ESG criteria.

By integrating these analytics capabilities into their business models, retailers create a culture of continuous improvement that supports both short-term wins and long-term ESG goals. Retailers that integrate AI-driven analytics into their ESG strategies foster continuous improvement, reduce costs, and position themselves as leaders in a sustainability-driven marketplace.

Cybersecurity in Retail: Building Trust and Resilience in a Privacy-Driven World

The rise of online commerce has transformed the retail industry, but with this growth comes a rising threat: cyberattacks. Retailers handle vast amounts of consumer data, from payment information to purchase history, making them prime targets for cybercriminals. Unfortunately, Microsoft projects that e-commerce payment fraud will exceed $90 billion annually by 2028. In fact, according to IBM’s 2023 X-Force Threat Intelligence Index, the retail industry ranked as the fifth-most targeted industry.

These risks have significant financial consequences. IBM’s Cost of a Data Breach Report 2023 found that retail breaches cost an average of $2.96 million per incident, while breaches in consumer goods were even more costly at $3.8 million. The time it takes to identify and contain these breaches is also concerning, with retail organizations taking 10 days longer than the global average to identify a breach and 9 extra days to contain it.

Yet, many retailers overestimate their preparedness, leaving gaps that increase risk.

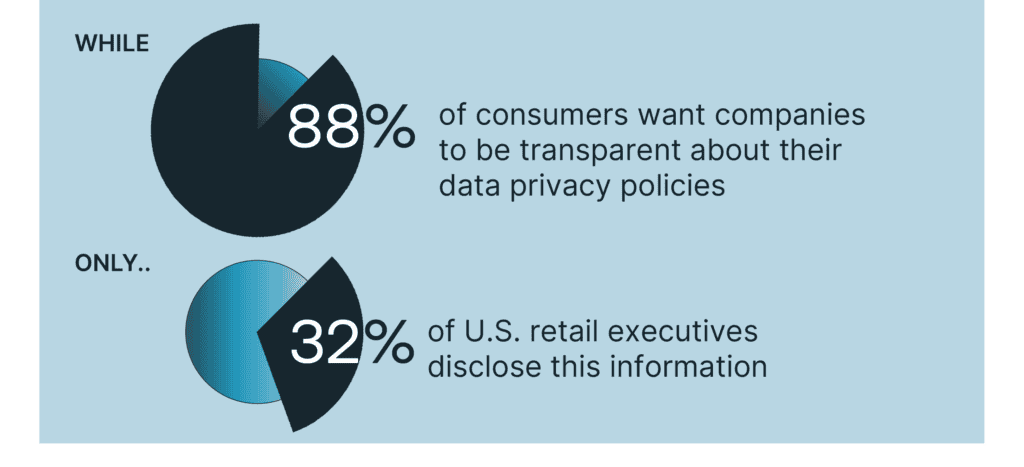

The trust gap: consumer expectations vs. executive action

Cybersecurity isn’t just a technical issue—it’s a trust issue. With 83% of global consumers prioritizing personal data protection, it’s clear that shoppers care deeply about how companies handle their information. However, while 88% of consumers want companies to be transparent about their data privacy policies, only 32% of U.S. retail executives disclose this information, highlighting a clear opportunity for retailers to build trust.

Transparency is not only good practice but also results in improved business outcomes. Consumers are more willing to share their data if they see value in return, such as personalized recommendations or exclusive offers. Retailers that prioritize transparency and strengthen their data privacy measures can foster long-term loyalty and differentiate themselves in a crowded market.

Bridging the gap with modern cybersecurity solutions

IBM’s research found that only 25% of retail companies and 29% of consumer goods businesses use extensive automation and AI-powered security solutions. This gap leaves them vulnerable to attacks that could otherwise be mitigated.

Automation and AI has proven to be game changers in the fight against cybercrime. Companies that adopt AI-driven security solutions can reduce the average lifecycle of a breach by 108 days and save up to $850,000 per breach. Since speed is one of the most critical factors in containing a breach, having AI-enabled tools that detect and respond to threats in real time can significantly reduce costs and limit reputational damage.

The road ahead: proactive security as a competitive advantage

With cyber threats on the rise and consumer expectations for privacy growing, retailers must shift from reactive to proactive security measures. This includes greater transparency about data privacy practices, the adoption of AI and automation to accelerate breach detection, and a commitment to closing security gaps before they can be exploited. By taking these actions, retailers can not only protect their customers but also gain an edge in a privacy-conscious market.

Mergers, Acquisitions, and Modernization in Retail: Trends to Recap in 2024

Retailers continue to seek to differentiate themselves through mergers & acquisitions (M&A), and partnerships. They are leveraging these deals to strengthen their portfolios, expand customer reach, and achieve operational efficiencies. Below, we explore the key M&A 2024 trends that has shaped the retail landscape.

1. Luxury Retail Consolidation to Fuel Growth

The luxury retail sector continues to thrive, with global market growth projected at 8% to 10% coming out of 2023, ultimately reaching an estimated $1.65 trillion. To capitalize on this momentum, luxury brands are pursuing acquisitions that allow them to access new markets, expand product lines, and capture synergies across operations.

Why It Matters:

- Portfolio Expansion: Acquiring complementary brands enables luxury retailers to attract new customer segments and diversify their offerings.

- Operational Synergies: Consolidation creates opportunities for cost savings in production, logistics, and marketing, enhancing profitability.

- Customer Experience: Unified operations often lead to more consistent and personalized customer experiences, building brand loyalty.

These moves position luxury retailers to sustain growth, remain agile in the face of market shifts, and increase profitability in an increasingly competitive space.

2. Convenience Stores Lead in M&A Activity Volume

With air travel costs increasing by over 25% and a rise in road trips and commuter traffic, convenience stores have seen a surge in usage. To capture this growing consumer base, large chains are merging to establish dominance in this high-traffic sector.

Why It Matters:

- Increased Foot Traffic: More commuters, driven by return-to-office mandates and increased travel, are frequenting convenience stores.

- Sector Expansion: Merging with smaller chains allows for rapid expansion into new geographies and increased customer touchpoints.

- Customer Loyalty: Consolidation enables convenience stores to introduce loyalty programs and personalized offers that encourage repeat visits.

This trend is expected to continue, with similar consolidation strategies anticipated in other segments of the retail industry as companies seek to maintain relevance in a crowded market.

3. Large-Scale Grocery Mergers Impact Customers

Grocery stores are under immense pressure to remain competitive, especially as labor and commodity costs rise. In 2023, grocery inflation reached 10.4%, making it difficult for retailers to compete on price alone. To navigate these challenges, large-scale mergers are being pursued to achieve greater market share and operational efficiencies.

Why It Matters:

- Price Competitiveness: Larger grocers can negotiate better deals with suppliers, reducing costs and maintaining lower prices for consumers.

- Operational Efficiency: Shared resources and logistics networks reduce delivery times and improve supply chain resilience.

- Customer Choice: Mergers can increase product variety while enabling smaller grocers to remain viable by pooling resources.

For consumers, these mergers could lead to more stable pricing and better access to fresh food. However, regulatory scrutiny is expected, especially if large chains are seen as reducing competition.

M&A Integration: An Opportunity to Modernize

As part of the M&A integration effort, companies are inevitably confronted with different technology stacks and systems. This challenge presents a unique opportunity not only to consolidate but also to modernize. This is an opportunity for retailers to invest in new technology that supports long-term growth and scalability. By adopting modern, future-ready systems, retailers can enhance operational efficiency, streamline processes, and position themselves for sustained success.

Conclusion: The Power of Data and AI in Retail

Retailers that harness the power of data and AI are better positioned to achieve sustainability, security, and operational excellence. By leveraging AI for ESG tracking, cybersecurity measures, and operational modernization, retailers can reduce costs, strengthen consumer trust, and drive growth. Data-driven decision-making and AI-powered insights are no longer optional—they are essential for retailers aiming to lead in an increasingly competitive and compliance-driven industry.

To learn more, catch Neudesic at NRF’s Retail’s Big Show in January 12-14 where we will be showcasing our retail industry solutions that leverage AI to improve store operations, supply chain and employee experience.

Related Posts